Based on insights from the ‘Exit Like a Boss Podcast – 21-Step Challenge‘, this blog covers Step 7 – Exit Options.

If you are a business owner contemplating the diverse range of exit options available for your venture, with around 15 to 20 potential routes to exit your business, it’s crucial to understand which of these are the most suitable and advantageous for you.

Understanding the Range of Exit Options

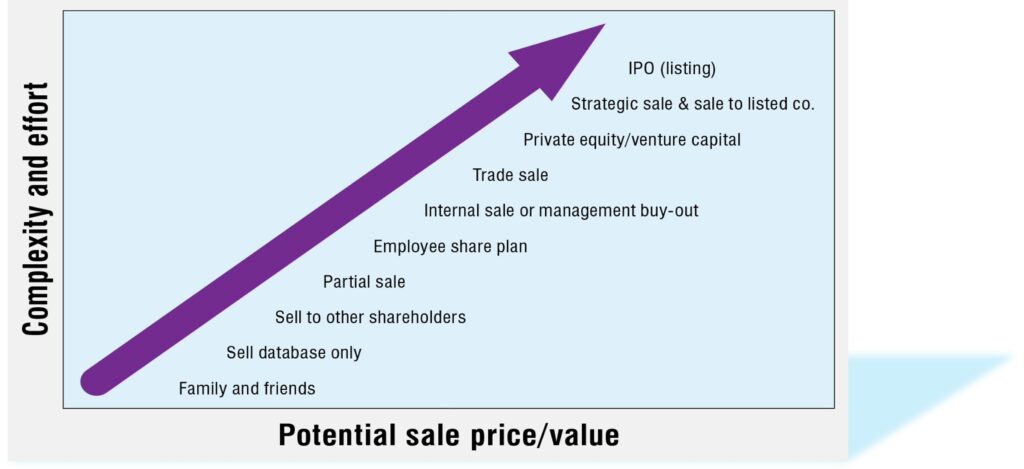

Here, we’ll delve into the most relevant exit strategies. These strategies exist on a spectrum, varying in complexity, cost, speed of implementation, and associated risks.

Transferring to Family and Friends

Starting at the simpler end of the spectrum, transferring your business to family, friends, or close associates is a quick and easy exit option. While it may not yield the highest financial returns, it involves minimal risk and associated costs.

IPO: The Pinnacle of Exit Strategies

At the more intricate end of the spectrum is listing your company on a public stock exchange through an IPO. Although it offers the highest financial return, this route is time-consuming, costly, and comes with inherent market risks.

Exploring Mid-Spectrum Options for Private Businesses

In the middle of the spectrum are several options tailored to private businesses, providing a balance of complexity and suitability for businesses not suited for a public listing or family transfer.

Strategic Approaches for Maximizing Value

Consider combining multiple exit strategies sequentially to maximize value at each step of the process. For instance, beginning with a management buy-in or employee share plan to secure key personnel, then partnering with a private equity firm to foster growth before ultimately selling the business to a listed company.

Understanding the fundamental drivers behind these exit strategies is vital. The dichotomy between financial harvest strategies and legacy or stewardship strategies defines the essence of your exit. Many business owners, particularly from the baby boomer generation, are increasingly considering a balanced approach, affording financial gains while ensuring the preservation of the business’s legacy.

Setting Goals for Your Exit Strategy

The importance of setting clear goals and outcomes for your exit strategy cannot be overstated. Your chosen strategy profoundly impacts your decision-making throughout the business journey, influencing hiring choices, organizational structure, and resource allocation.

In conclusion, your exit strategy is not merely an endpoint – it’s a compass that guides your business decisions. Understanding your desired exit option, whether it’s a financial harvest or a legacy-focused approach, empowers you to steer your business towards a prosperous and meaningful future. Gear up to exit like a boss, knowing that your strategy aligns with your vision and values, paving the way for a successful transition.

This article was originally published on capitaliz.com.

Interested in offering staff a stake in your business?

Get your free ESS guide.