Employee Ownership

Crafting Effective Remuneration and Incentive Plans for Small Businesses Using Key Performance Indicators (KPIs)

Key Performance Indicators (KPIs) are vital for small businesses as they provide measurable values demonstrating how effectively a company achieves its key business objectives. KPIs should align with the business strategy to ensure they measure company progress and success through effective performance measurement. Additionally, KPIs cover various metrics related to financial, customer, and marketing aspects, all contributing to tracking and achieving business growth. For small businesses, KPIs should be specific, relevant, and achievable. Here are some examples and best practices:

Key Performance Indicators will ensure you are firstly, measuring and secondly, improving the key metrics that will deliver your business objectives. Whether you are trying to improve customer satisfaction, cash flow or financial metrics like gross profit margin your choice of the right key performance indicator is critical.

How to use key performance indicators?

Peter Drucker said “If you can’t measure it – you can’t improve it” – this is especially true for small business owners who can use business KPIs to manage the company’s ability to achieve its goals. Utilising KPIs allows small business owners to make data-driven decisions that can significantly impact their company’s success. Unfortunately for many, there is just too much to measure – gross profit, net profit, operating costs, revenue growth rate, accounts receivable, inventory turnover, quick ratio, new customers, average order, revenue, sales, current liabilities etc. – this list of metrics to track could be three pages long.

Finding the important business KPIs to ensure the business is financially healthy and can achieve its strategic objectives is the first place to start for a small business owner.

In many cases, we utilise KPIs with Succession Plus clients for two main reasons – to measure and improve performance as part of our value acceleration programs and also to help determine the best way to allocate shares in our Employee Share Ownership Plans (ESOP).

Examples of KPIs for Small Businesses

1. Financial KPIs: Gross Profit Margin

Financial KPIs are crucial for assessing the financial health of a small business.

- Revenue Growth: Measures the increase in the company’s income over time.

- Gross Profit Margin: Shows the percentage of revenue that exceeds the cost of goods sold.

- Net Profit Margin: Indicates how much of each dollar in revenue translates into profit.

- Cash Flow Forecast: Projects future cash inflows and outflows to predict ability to meet financial obligations.

- Accounts Payable Turnover: Measures how efficiently a company pays off its short-term debts, helping to determine if steps need to be taken to reduce spending.

- Ability to Cover Operating Expenses: Assesses the importance of being able to cover operating expenses at any given moment, which is critical for evaluating business profitability and ensuring the company’s short- and long-term outlook.

2. Customer-Related KPIs: Customer Acquisition Costs

- Customer Lifetime Value (CLV): Estimates the total revenue a business can reasonably expect from a single customer account. Customer retention is equally important as it measures the ability of a business to keep its customers over time.

- Customer Acquisition Cost (CAC): The cost of convincing a customer to buy a product/service. Customer acquisition costs factor in expenses for marketing, technology, and payroll. It is crucial to compare CAC to customer lifetime value to ensure a sustainable business model.

- Net Promoter Score (NPS): Gauges customer satisfaction and loyalty by measuring the likelihood of customers recommending the business to others.

3. Operational KPIs: Operating Expenses

- Inventory Turnover: Measures how often inventory is sold and replaced over a period. Process optimisation is key to improving operational efficiency and reducing costs.

- Order Fulfilment Cycle Time: The time from receiving a customer order to delivering the product or service.

- Employee Productivity: Output per employee can be measured in various ways depending on the business type.

4. Marketing KPIs

- Conversion Rate: The percentage of website visitors who take the desired action. Lead generation is a crucial metric for evaluating the effectiveness of marketing efforts.

- Cost Per Lead: The cost of acquiring a lead helps evaluate the effectiveness of marketing campaigns.

- Social Media Engagement: Measures interactions (likes, shares, comments) on social media platforms.

5. HR-Related KPIs

- Employee Turnover Rate: The rate at which employees leave the company.

- Employee engagement is a critical factor that influences overall job satisfaction and productivity.

- Employee Satisfaction Can be measured through surveys and interviews.

- Training ROI: The return on investment from employee training programs.

Best Practices for KPIs in Small Businesses

- Alignment with Business Strategy: KPIs should be directly aligned with the strategic goals and objectives of the business. Strategic alignment ensures that KPIs are directly linked to the business’s long-term goals and objectives. Incorporating KPIs into the business strategy ensures they are meaningful and act as a core enabler of success.

- Specific and Measurable: Each KPI should have a clear definition and a specific way to measure it.

- Achievable and Relevant: KPIs should be realistic and relevant to the business’s current stage and capabilities.

- Regular Monitoring and Review: KPIs should be reviewed regularly to track progress and make necessary adjustments.

- Communicate Clearly: Ensure that all team members understand the KPIs, their importance, and how they can contribute to achieving them.

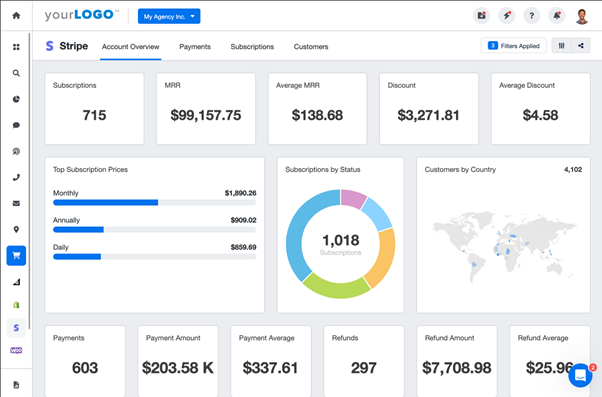

- Use Technology Wisely: Utilise software and tools for accurately tracking and reporting KPIs.

- Act on Insights: KPIs are not just for measurement; they should inform business decisions and strategies.

- Balance Between Short-term and Long-term KPIs: Have a mix of KPIs that measure both immediate results and long-term objectives.

- Customisation: Customise KPIs to fit the unique aspects of the business, industry, and market context.

- Employee Involvement: Involve employees in the setting and reviewing of KPIs to enhance engagement and accountability.

KPIs are not just metrics; they reflect the business’s strategy and operational effectiveness. For small businesses, they are tools for growth, providing insights that help steer the business in the right direction.

Professional Service Firm Small Business Example

In a professional services firm, tracking a variety of financial metrics is essential to understand and improve business performance. Fortunately, modern software packages have made it easier for business owners to monitor these metrics, which were historically limited to basic measures like cash flow (bank balance) and net profit. By expanding the scope of tracked metrics, business owners can gain deeper insights into their company’s strengths and weaknesses, allowing for more informed decision-making and strategic planning. Here are some key performance indicators (KPIs) that small businesses in professional services should consider:

Firm or business KPIs

- Net Labour Multiplier: This KPI measures the efficiency and profitability of labor. For example, a net labor multiplier of 2.5 times salary indicates that for every dollar spent on salary, the firm generates $2.50 in revenue. Maintaining a high multiplier is crucial for profitability.

- Net Profit Margin: This KPI shows the percentage of revenue that remains as profit after all expenses are deducted. A net profit margin of 15% or greater is generally considered healthy, indicating that the firm efficiently manages its costs relative to its revenue.

- Staff Turnover Rate: Keeping staff turnover below 5% per annum helps maintain stability and reduce the costs associated with recruiting and training new employees. Low turnover rates also reflect high employee satisfaction and engagement.

- Customer Satisfaction (Net Promoter Score): This metric gauges how likely customers are to recommend the business to others. A high Net Promoter Score (NPS) indicates strong customer satisfaction and loyalty, which are essential for long-term success and growth.

Monitoring these KPIs helps ensure that the business is financially healthy and on track to meet its strategic goals. Regular review and analysis of these metrics can highlight areas for improvement and inform necessary adjustments.

Project KPIs

- Sales Conversion or Win/Loss Ratios on Proposals/Quotes: This KPI measures the effectiveness of the firm’s sales efforts by comparing the number of successful proposals or quotes to the total number submitted. A high conversion rate indicates a strong sales process and effective client engagement.

- Profit by Project: Tracking the profitability of individual projects helps identify which types of projects or clients are most lucrative. This information can guide future business development efforts and resource allocation.

- Project Completion on Time and Within Budget: Ensuring that projects are completed on schedule and within the allocated budget is critical for maintaining client satisfaction and managing costs. Effective project management practices are essential to achieving these outcomes.

Monitoring project KPIs allows firms to assess the efficiency and effectiveness of their project management processes, ensuring that they can deliver high-quality results to clients while managing resources effectively.

Individual KPIs

- Utilisation Rate Greater than 75%: This KPI measures the percentage of an employee’s available working hours that are billable to clients. A utilisation rate above 75% indicates that employees are effectively contributing to revenue-generating activities.

- Revenue Target of Three Times Salary: Setting a revenue target of three times an employee’s salary ensures that the firm generates sufficient income to cover costs and achieve profitability. This target helps align individual performance with overall business goals.

- Work in Progress (WIP) Recovery at Greater than 85%: This KPI measures the efficiency of converting work in progress into billable hours or completed projects. A recovery rate above 85% indicates that the firm effectively manages its workload and minimises waste or unbillable time.

Tracking individual performance through these KPIs helps identify top performers and areas where additional support or training may be needed. It also ensures that employees’ efforts are aligned with the firm’s strategic objectives.

By leveraging these KPIs, small businesses in professional services can gain comprehensive insights into their financial health, project management efficiency, and individual employee performance. Regularly monitoring and acting on these metrics will help ensure that the business remains competitive, profitable, and poised for growth.

Dashboards – not just financial metrics

Effective KPIs are essential tools for small businesses aiming to track performance, achieve strategic goals, and drive growth. By aligning KPIs with your business strategy, you can make data-driven decisions that enhance financial health, customer satisfaction, and operational efficiency. At Succession Plus, we specialise in helping businesses like yours identify and implement the right KPIs to ensure sustainable success.

Don’t navigate this journey alone. Contact us today to determine where your business stands and how we can assist in improving your performance. Together, we can set your business on a path to achieve its full potential.

Interested in offering staff a stake in your business?

Get your free ESS guide.