Business Value Acceleration

Decoding Business Valuation: Key Terms and Concepts Every Entrepreneur Should Know

We understand that business valuation is a complex process involving numerous key terms and concepts. Whether you’re buying, selling, investing, or managing a business, understanding the dialect of valuation is your ultimate trump card.

Mastering key terms like EBITDA and Leveraged Buyout (LBO) Valuation isn’t just about making you look more credible and knowledgeable – it’s about fostering trust with partners, empowering informed decision-making, and ultimately, maximising your business’s worth. Ignorance of these terms can leave you vulnerable in negotiations and making poor financial decisions.

Below is a list of key terms every entrepreneur should know:

Fair Market Value (FMV)

The price at which a business would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Book Value

This is the value of the business according to its balance sheet, calculated as total assets minus total liabilities. It reflects the net value of the company’s assets.

Earnings Before Interest, Taxes, Depreciation, and Amortisation (EBITDA)

A measure of a company’s overall financial performance, EBITDA is used as an alternative to simple earnings or net income. It’s essentially net income with interest, taxes, depreciation, and amortisation added back in.

Discounted Cash Flow (DCF)

A valuation method is used to estimate the value of an investment based on its expected future cash flows. These cash flows are adjusted (discounted) to account for the time value of money.

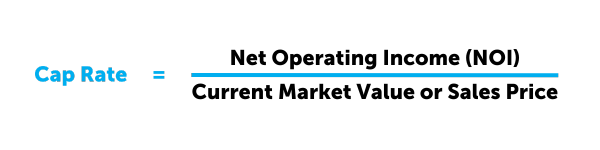

Capitalisation Rate (Cap Rate)

Used in the income approach to valuation, this rate is used to estimate the value of a business based on its annual rate of return. It is calculated as the business’s net operating income divided by its current market value or sales price.

Multiples Method

A valuation technique where a company’s value is determined by multiplying its financial metrics (like EBITDA, sales, or profits) by an industry-standard or comparable sales figure.

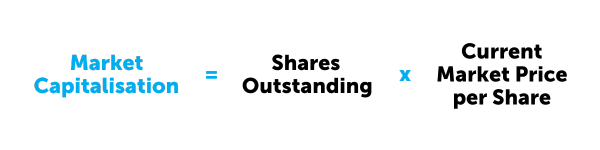

Market Capitalisation

The total dollar market value of a company’s outstanding shares of stock. It is calculated by multiplying a company’s shares outstanding by the current market price of one share.

Goodwill

The intangible asset that arises when a buyer acquires an existing business. Goodwill represents assets that are not separately identifiable. It includes factors like brand reputation, customer relations, and intellectual property. Valuing goodwill requires more than just crunching numbers – it calls for expertise honed through experience. With our proven methods and years of experience, let us help you to accurately assess the true worth of your intangible assets.

Liquidation Value

The estimated amount that would be received if all of a company’s assets were sold individually and its liabilities settled. It’s often lower than the market or book value.

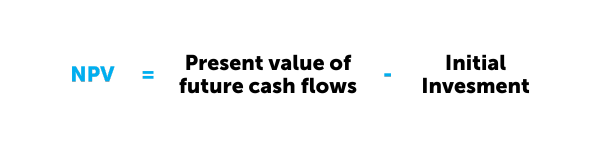

Net Present Value (NPV)

A method used in DCF valuation calculates the present value of future cash flows minus the initial investment cost. It helps in determining the profitability of an investment.

Tangible and Intangible Assets

Tangible assets are physical assets like machinery, buildings, or land. Intangible assets are non-physical assets like patents, trademarks, and goodwill.

Leveraged Buyout (LBO) Valuation

This strategy involves acquiring another company using a significant amount of borrowed money (bonds or loans) to meet the acquisition cost.

Minority Discount

A reduction in the valuation of a minority ownership interest in a business due to the lack of control and marketability associated with minority shares.

Control Premium

The amount a buyer is willing to pay over the current market price to acquire a controlling share in a company. This premium is paid for the ability to take control of the company.

Due Diligence

The comprehensive appraisal of a business undertaken by a prospective buyer, especially to establish its assets and liabilities and evaluate its commercial potential.

Business evaluation encompasses a myriad of essential terms and concepts. A comprehensive understanding of these terms is crucial as an entrepreneur engaged in all parts of buying, selling, investing, or managing a business. Each term captures a distinct facet of the business’s value and potential and paints a comprehensive picture of its financial health and future prospects.

For more information on how to enhance the value of your business, you can download our free ebook to understand exactly what a private owned business is worth, what exit options are available, and what needs to be done to maximise its value.

Interested in offering staff a stake in your business?

Get your free ESS guide.